By Ana Monteiro

Supply-chain constraints continue to rank among the top headaches for US businesses, two reports showed, generating more anxiety about the outlook for the economy.

The Federal Reserve’s Beige Book, covering economic conditions from mid-April through May 23, showed that contacts in all of the Fed’s 12 districts spanning Boston to San Francisco grappled with supply-chain issues that either limited their productive capacity, raised costs, muddled transport plans, curbed orders, crimped expansion or added to backlogs.

Eight districts reported that expectations of future growth among their contacts had diminished, while contacts in three districts “specifically expressed concerns about a recession,” the Fed said. (For Jonnelle Marte’s full story, click here.)

Despite the impediments, US manufacturing activity unexpectedly increased in May as new orders and output growth accelerated, according to Institute for Supply Management. Its gauge of factory activity climbed to 56.1 last month from 55.4 in April. (For more, read Vince Golle’s piece here.)

However, average lead times for capital expenditures grew to 178 days, the highest in data back to 1987, the ISM said. Production-material lead times eased slightly to 99 days from a record 100 days a month earlier.

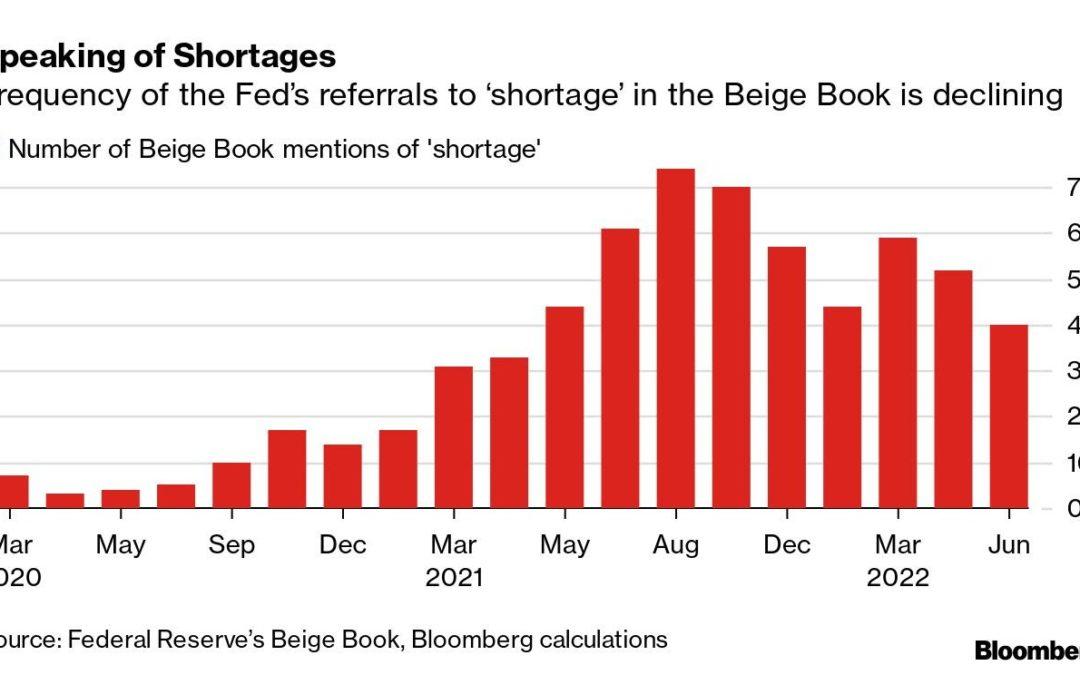

Speaking of Shortages

Frequency of the Fed’s referrals to ‘shortage’ in the Beige Book is declining

Source: Federal Reserve’s Beige Book, Bloomberg calculations

Companies are taking different approaches to deal with the scarcity and logjams, according to the Beige Book:

- Some are opting for alternatives that come at higher prices, with the Atlanta Fed district reporting that a few contacts shifted to shipping freight by air, though it was much more costly. In the Cleveland Fed area, an airport contact reported a recent double-digit increase in air cargo volume.

- Other firms are sitting out this round — a salvage store in the Boston Fed district that enjoyed a better-than-expected increase in recent sales rejected some potential inventories over high freight costs.

- Concerned about not having access to stock, several companies in the Cleveland Fed’s district temporarily moved away from just-in-time inventory management to stockpiling supplies where they could. A San Francisco Fed manufacturing contact “mentioned maintaining approximately three months of additional inventory of supplies.”

- In the Kansas City Fed’s patch, some importers of consumer products slightly reduced their orders for goods to be delivered later in the year because of concerns that lockdowns in China would increase input prices and worsen supply-chain issues.

- Freight brokers in the Atlanta region reported “a slight pullback” in the van-sector spot market — partly due to a shift away from goods purchases towards spending more on services — but demand for flatbeds was steady as housing and construction activity remained high.

For retailers, ensuring there’s sufficient, appropriate stock on hand when it’s needed while navigating snarled logistics networks mean they “have a lot to get right,” Goldman Sachs analyst Kate McShane said on a call with reporters Wednesday.

“If we’re going into an environment where we’re going to see a little bit less demand because of how the consumer’s feeling and maybe a little bit more supply because these retailers are still trying to chase categories because of the congested supply chain, it does increase the risk for markdowns in the back half of the year,” McShane said.

—Ana Monteiro in Washington