Shipping strains are on the mend, but a painful spell of weaker demand might be next.

Rock guitarist Jack White, who extended his “Supply Chain Issues Tour” into October, might want to name his band’s next road trip after a different villain.

That’s because supply strains, while still afflicting many consumers and businesses, are becoming more mundane than menacing like they were six months ago, especially in the US. Snarls have eased back from their pandemic peaks and some are already adding less inflationary pressure.

Modest improvements are showing up in gauges maintained by forecasters ranging from Bloomberg Economics to the Federal Reserve Bank of New York. But the gradual end of the pandemic-driven supply crunch might give way to another potential headache: a slump in consumer demand that throws economic growth into reverse and leads to an ugly inventory pileup.

“Pressures in the global goods sectors, which have been a central driver of inflation, may finally be easing,” Citi economists led by Nathan Sheets wrote in a research note this month. “The bad news is that this looks to be occurring on the back of a slowing in the global consumer’s demand for goods, especially discretionary goods, and thus may also signal rising recession risks.”

Citi cautioned against declaring an “all clear” on the supply front, and there are reasons to doubt whether clogs in the plumbing of global trade will be cleared any time soon — as the following lineup of charts illustrates. Labor strikes, factory disruptions tied to Covid outbreaks in China, Russia’s war in Ukraine, and year-end holiday shipping pressures could tangle logistics networks all over again.

Here’s the latest reading of US supply strains fromOxford Economics, which has fallen for three straight months:

Inching Back to Normal

Oxford’s US supply-strain index has fallen for three straight months

Source: Oxford Economics’ U.S. Supply Chain Stress Tracker

Economists generally agree that US household demand for merchandise will be key to watch in coming months, but they’re split about whether it will stay strong or start to soften. One private indicator suggests it might be poised to tip back toward normal as people dine out, see shows, and travel more than they did during the pandemic.

To help pinpoint this shift back to services spending, Flexport Inc. developed its Post-Covid Indicator to monitor how Americans’ divvy up their paychecks. The latest reading shows “consumer preferences shifted slightly away from goods in May,” the San Francisco-based freight forwarder said. “Looking ahead, the indicator is forecast to hold at close to current levels throughout the third quarter of 2022. That would imply that overall consumer preferences for goods over services will decline but still remain slightly above summer 2020 and pre-pandemic levels.”

So Far So Goods

Flexport data shows goods purchases starting to slow vs services

Source: Flexport

*Flexport’s Post-Covid Indicator compares the balance of spending in summer 2020 (PCI = 100) to spending before the pandemic (PCI = zero)

Controlling some levers of economic activity is the Federal Reserve, which is set to raise interest rates later this month to try to curb surging inflation. According to the central bank’s most recent regional survey, businesses are still dealing with plenty of supply problems but they seem to be fading in severity.

US Economy Careens Between Glee and Gloom With Each Data Release

Here’s a not-so-scientific tally of where things stand in the Fed’s recent observations: the number of times the word “shortage” appears in this survey, called the Beige Book. These could be references to shortages of labor, materials or other keys to production. While the number is still more than double its pre-pandemic level, it has declined to about one-third of its peak in August 2021:

Speaking of Shortages

Frequency of the Fed’s referrals to ‘shortage’ in the Beige Book is declining

Source: Federal Reserve’s Beige Book, Bloomberg calculations

Another indicator of emerging supply slack after two years of tightness: Ocean freight rates have continued their decline from record highs. And the fact that it’s happening during what’s usually peak season for global shipping leads some observers to conclude that a market that lacked any excess capacity just a few months ago is rapidly swinging back in the other direction.

Container rates, including these published by Freightos, a digital platform for cargo bookings, are still well above pre-pandemic levels but their trajectory looks increasingly like a slide still searching for a bottom amid uncertainty about consumer spending:

Halfway Back to Normal

Ocean shipping rates have dropped halfway back to early-2021 levels

Source: Freightos.com

*FEU = 40-foot containers; spot rates including premiums and surcharges

Much of the logistics recovery hinges on China’s ability to remain a trade powerhouse and keep factories and ports humming through its strict rules to control Covid outbreaks. That looked to be intact after the country released numbers on Thursday showing June was the country’s second-best month for exports in at least three decades.

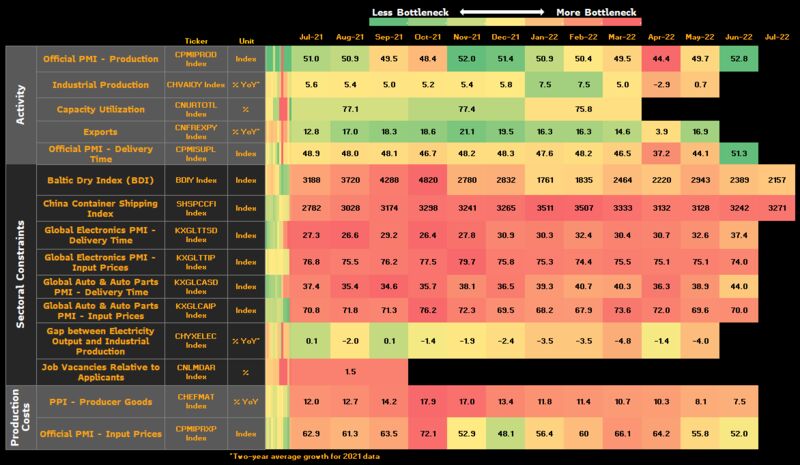

Eric Zhu of Bloomberg Economics published a supply-chain dashboard focusing on China recently that showed production there rebounding and delivery times shortening after Shanghai lifted virus restrictions. That heat map is flashing some rare shades of green and a little less bright orange:

Not everything is on the mend, particularly in Europe, which is seeing extended shipping problems given the region’s proximity to the fighting in Ukraine. Sanctions on commodities and other items originating from or headed to Russia are complicating European trade flows, particularly from Asia. On top of that, labor disruptions like the one affecting Germany’s big seaports in recent days will only prolong the recovery efforts.

Figures from the Kiel Institute for the World Economy show congestion has already been building at ports in northern Europe and creeping higher along the US East Coast, where ships are queueing for days or even weeks from Georgia to New York waiting to offload their cargo:

European Shipping Snarls

Congestion at European and US East Coast ports is elevated or rising again

Source: Kiel Trade Indicator

*Waiting ships as a share of global capacity

Another indicator that supply stress may not ease very quickly: On Friday, Commerce Department figures showed American retail sales rose more than economists forecast in June, data that Yelena Shulyatyeva and Andrew Husby of Bloomberg Economics said “imply there’s still enough momentum for the US economy to grow during the rest of the year as consumers find ways to cope with surging inflation.”

That outlook bodes well for container imports into the US, which stayed solid through June and look resilient at the ports of Los Angeles and Long Beach, California, through July so far.

Inbound Cargo Flows

US container imports hit a record in May and showed little weakness in June

Source: Port data compiled by Bloomberg

*Inbound volumes for 33 US container ports / **TEU = 20-foot container units

Gene Seroka, the executive director of LA’s port, said he’s cautiously optimistic for the second half of the year.

“We’ll be seeing back-to-school, fall fashion, Halloween and the all-important year-end holiday goods coming across the Pacific in the weeks and months ahead,” he said during a press briefing last week. “Even though some retailers have high inventories and may look to discount goods, I expect imports to remain strong — though tapered — versus last year.”

He added some words of warning: Train congestion is building again, with more than 29,000 rail containers delayed on LA’s docks — a bottleneck Seroka said ought to be closer to the “9,000 range.” Rail-bound cargo is sitting an average of 7.5 days when ideally it shouldn’t exceed two. Stakeholders need to take action now, he said, “to avoid a nationwide logjam.”