Canceled sailings, stuck vessels, warehouse prices show U.S. ports are still struggling

- An increase in container vessels anchored off of Savannah and Houston is one sign of a global shipping industry that has moved more cargo away from the U.S. West Coast.

- A big beneficiary is East and Gulf coast warehousing, where higher container delivery volume is pushing up prices.

- Ocean carriers are canceling sailings as result of U.S. port congestion, and even as container volume from China is way down, U.S. ports continue to have productivity issues.

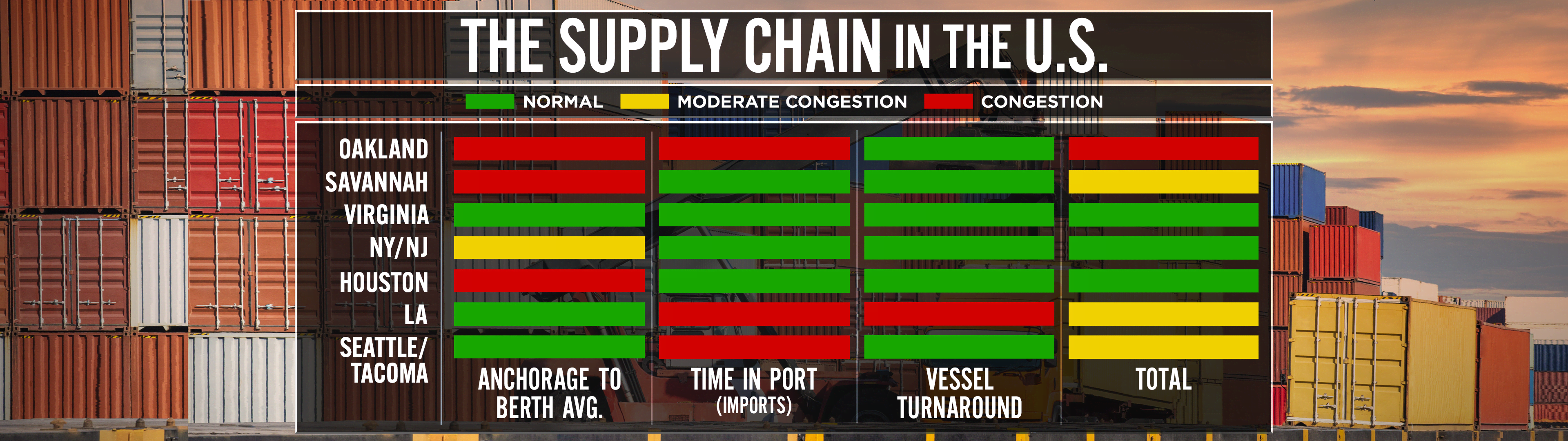

Ocean carriers continue to cite congestion at U.S. and Canadian ports as the reason for canceling sailings in September, a cut in vessel service that has been flagged in previous CNBC reporting, and the latest CNBC Supply Chain Heat Map shows the congestion is not subsiding.

“It comes as no surprise ocean carriers are blanking (canceling) sailings,” said Alan Baer, CEO of OL USA. “It needs to be done to regain some sort of schedule reliability.”

The result is that all of these vessels will now be out of position for return voyages, moving containers, loading U.S. exports, and ultimately being in a position to load imports.

“A lot of this was the result of moving freight away from USWC arrivals due to labor disruption risk,” Baer said.

MarineTraffic has tracked an increase in the number of vessels anchored off the East Coast and Gulf ports.

More complications for East Coast ports are anticipated as a result of the strike at Felixstowe, which may hit U.S. imports once the backlog starts to get sorted out, according to Captain Adil Ashiq, United States Western Region executive for MarineTraffic.

“This means Holiday goods could end up reaching shelves closer to the start of the holiday season — it may prudent to seek alternative modes of transport if possible,” Ashiq said.

According to MarineTraffic data, Port of Savannah has 39 vessels at anchor. In the Gulf, at the Port of Houston, there are 22 cargo ships at anchor.

The port congestion has ocean carriers, most recently MSC, announcing modifications to its vessel schedule. In July, Seko Logistics and Worldwide Logistics explained to shippers the East Coast congestion was impacting the arrivals of vessels back to Port of Shenzen for reloading.

The increase of containers on the East Coast is benefiting the warehouse sector, with warehousing costs increasing fast on the East Coast, up 8 percent since January, according to Jordan Brunk, CMO of WarehouseQuote.

Pricing on the West Coast has decreased consistently for the past two months, but Brunk still described rates as “expensive.” But he added, “We are seeing a shift of freight that was traditionally held on the West Coast now moving to the Northeast and Southwest.”