Prices of PE, PS may have peaked; they were slightly down for PP and PET, up for PVC.

The pricing outlook for the five-volume commodity resins was mixed in April, and perhaps even more so going into May and June. While prices for PE and PS may have peaked, tabs for PP and PET moved slightly lower and PVC went higher. Among contributing factors were lower feedstock prices, higher resin inventories, lower operating rates, uncertain demand outlook, and continued logistical issues. As previously reported, higher costs and supply constraints of key additives were yet another continued factor.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at Spartan Polymers.

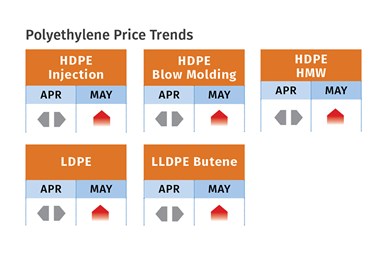

PE Prices Flat

Polyethylene prices in April appeared to be flat, though some suppliers were pushing to implement their April 6-7¢/lb increases and issued further hikes of 6-7¢ for May, noted PCW senior editor David Barry, The Plastic Exchange’s Greenberg, and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets.

PCW’s Barry ventured that PE suppliers would be lucky to get part of the April increase in either April or May. Still, all sources expected PE prices to remain firm through June, and afterward would depend on whether demand continues strong and the impact Shell’s new PE plant on the market when it becomes fully operational in the third quarter.

Reporting that suppliers did not like the call from one influential pricing index that April PE contracts would roll over unchanged, The Plastic Exchange’s Greenberg noted that spot PE prices moved up by 2¢ to 4¢/lb in April. He also noted that while March PE exports rose roughly 30% from the previous month, logistical constraints continued. “Houston warehouses are still packed with resin, empty railcars to refill by producers are scarce, key rail lines are congested, and trucks are in short order—all of which lends itself to additional upward pricing pressure for PE.”

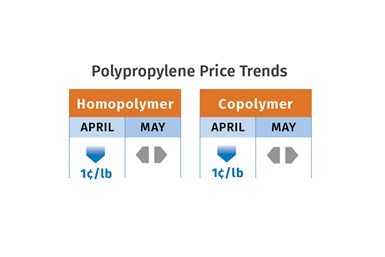

Polypropylene prices in April fell 1¢/lb in step with propylene monomer, after spiking up a total of 16¢ in the previous two months. Meanwhile, suppliers announced “non-monomer” increases of 6¢/lb, in addition to any change in monomer, according to Barry, Greenberg and Newell.

Said Newell,“Market fundamentals do not support a 6¢ margin expansion, but suppliers have reduced operating rates to 80%, which, along with a couple of force majeure’s, supports their increase. If demand strengthens and plant operating rates go back up to 85% or more, propylene monomer prices will be pressured upwards due to already tight supply.”

Barry noted that while some short-term supply dynamics support a margin increase, this will not hold up in the longer term. He expected logistical issues to improve and freight costs to come down, at which point suppliers would then be faced with much lower-cost PP imports. (In April, PP exports to Mexico from the U.S. were at $1.00 to $1.10/lb, whereas PP shipments from elsewhere were in the high 70¢/lb range.) Greenberg reported in late April that sales to Mexico were strong, but PP prices were not competitive with those from other regions, due to “challenged logistics and limited ship space.”

All three industry sources noted that suppliers could get at least part of their non-monomer increase. Newell predicted that PP prices this month could drop about 5¢/lb. Barry ventured that June PP pricing would be mostly flat, with no further margin expansion, but added, “June is traditionally a stronger demand month. If crude oil stays at $100/bbl, propylene monomer prices will stay firm.”

PS Prices Peak

Polystyrene prices in April moved up by another 9¢/lb, following March’s 4¢/lb hike, but they may well have peaked, according to RTi’s Chesshier and PCW’s Barry. Both sources noted that market fundamentals do not support high PS prices and saw a flat-to-downward trend as most likely for May to June, barring a major disruptive event.

Barry noted that the key driver lately had been rising prices of styrene monomer due to supply tightness. Going into this month, he thought suppliers would find it hard to hold onto the higher PS prices since a correction in the monomer supply situation was expected. The implied styrene cost based on a 30/70 formula of ethylene/benzene, calculated weekly by OPIS (owner of PCW), was 45¢/lb to 50¢/lb through April. Chesshier noted that suppliers’ increases to date were 6¢/lb above the feedstock cost increases. She also noted that prices for both benzene and butadiene were holding steady, and styrene monomer spot prices had dropped 14¢/lb by April’s end.

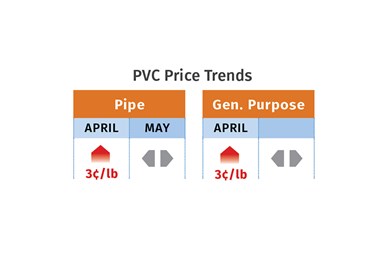

PVC resin prices in April settled 3¢/lb higher, following a March 1¢ hike (out of the 4¢/lb sought by suppliers), according to Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd. Meanwhile, there were nominations for a 3¢/lb contract increase for May.

Kallman noted that prices in May-June could be flat, due to more balanced supply/demand fundamentals, lower feedstock costs and lower exports due to a bottlenecked supply chain. Still, he noted that a lot would depend on continued robust demand from the construction sector and the impact of a scheduled maintenance shutdown in May.

PET Prices Slightly Lower

PET prices in April dropped 1.5¢/lb in step with a similar drop in net feedstock costs, according to RTi’s Kallman, after having moved up 7¢/lb in March. Based on feedstock formula pricing, Kallman ventured that PET prices in May-June would likely be flat to slightly lower. Barring any crude oil price escalation, he saw feedstock prices staying relatively flat, thanks to improved supply availability. “The market is still tightly balanced, with one recent PTA force majeure, and with continued PET imports.”